Why Are So Many Tech Bros Glib Malignant Narcissists?

More importantly, can anything stop them before they crash the world economy?

Even if you have zero interest in cryptocurrency, you don’t understand it or want to understand it, you need to pay attention. The entire crypto market is in thermal nuclear meltdown right now, which makes it unwise for you or for anyone to ignore the radioactivity. Failure to do so will result in you having missed your chance to witness one of the greatest Ponzi schemes in American history, a grift happening right now and in plain sight, an event your grandchildren’s grandchildren will be asking about.

I will touch on the crypto calamity that just went down (spoiler alert: scam-artist/edgelord/crypto bro Sam Bankman-Fried just filed for bankruptcy after fleecing investors out of billions of dollars in a scandal of Enron proportions), and I want to also discuss the meltdown that’s happening on Twitter, but here’s what I’d really like to talk about in this edition of Cappuccino: what’s wrong with these people? That’s not a rhetorical question, but an honest attempt to analyze the character flaws they all share, and what must be done to staunch a financial hemorrhage that has far-reaching implications for all of us.

Full disclosure: cryptocurrency is a low-key obsession of mine. Not from an investor standpoint. I own no cryptocurrency nor am I likely to. On the contrary, what fascinates me as a human and as a writer is that crypto is such obvious swamp water and yet so many people are drinking it. I’ll explain why as we go along. But I have devoted hundreds of hours of my life to reading, watching, and listening to every scrap of information I can on the subject. Ask me a question about crypto, and I can likely answer it.

First, I will start with what is, for me, the defining quote of our times, one that encompasses the most wretched excesses of unfettered capitalism and is also a salient yet unpalatable truth about human nature.

In the interests of clarity, I am not anti-capitalist, per se. As an economic system, capitalism works. But it only works for everyone when it is properly regulated. And the most glaring deficiency of tech in general and crypto in particular is that none of it—and I mean none of it—is regulated, mostly because the oldsters making the rules don’t understand the first thing about tech. In fact, some of them don’t know how to send an email.

This brings me to my second-most hidebound belief: money does not have an illustrious history of bringing out the best in people. Quite the opposite. Many who are successful at making money, by fair means or foul, invariably want more of it, and a sizable percentage don’t care how they get it.

I don’t believe this personality flaw is exclusive to the rich, although it appears to be exacerbated in part by wealth; greed is in all of us, even you, even me. No, this compulsion to acquire more and more and more is how we’re hardwired. It’s no coincidence that three of the world’s most influential prophets—Jesus, the Buddha, and Muhammad—were either poor or opted to be poor in an effort to help them escape the baleful influence of money. Houston mega-pastor Joel Osteen with his popular “prosperity gospel” may not agree, but the facts speak for themselves.

Applied correctly, regulation and oversight curb our natural tendency to greed. They ensure that no one is crushed beneath the wheels of capitalism and that everybody is playing by the same rulebook. Republicans hate it, of course. Regulation and oversight are an infringement on their “freedoms,” you see.

Their freedom to do what though? All too often, laissez-faire capitalism (fancy talk for no oversight) leads to exactly what we have right now, which is pigs gorging at the trough and leaving piles of steaming excrement for the rest of us to clean up.

If tech were properly regulated, Facebook would have never been allowed to sell off not just our private information but our psychological profiles. If tech were properly regulated, Facebook would have never been allowed to disseminate fake news about Covid vaccines, which would have saved millions of lives. If tech were properly regulated, the Big Lie about the 2020 election, Q-Anon conspiracy theories, and quite possibly Donald Trump himself would have never gained traction.

More to the point, if tech were properly regulated, a boorish, egomaniacal South African tech mogul like Elon Musk wouldn’t own Twitter. Two weeks in, and already the social media platform is in freefall.

Republicans love to talk about job creation, but when it comes down to it, they are usually the first ones to start dropping bodies. In a veritable bloodbath of dysfunction, rushed ideas, and layoffs, Musk has fired 4,400 of his 5,500 contract employees with no notice or warning, in addition to almost 4,000 regular employees—roughly half his workforce—some of whom he has had to beg to come back because nothing works anymore. Most of these firings were conducted by automated email.

Why?

Tech “geniuses” know absolutely nothing about people.

These were the STEM nerds in high school, guys and some gals who sat alone during lunch or in small forgettable clumps. They dressed funny. They talked funny. Some of them had trouble making eye contact. You heard through the grapevine that one or maybe two of them could do some impressively screwy stuff, like make a car bomb out of a Coke can and some paper clips. A few went on to become Bill Gates, Michael Dell, Mark Zuckerberg, and (Paypal founder/extremist right-winger) Peter Thiel. While the football jocks who peaked in high school eventually got married, got fat, and now wear specially made gym shorts while earning 30 grand a year teaching 7th grade girls how to spike a volleyball, the social pariahs in white socks, birth-control glasses, and plaid button-downs moved to major metropolitan areas and got kickin’ jobs.

The social ladder has inverted itself. It’s nerds-on-top now. And those nerds are determined to make the rest of us pay for what we did to them.

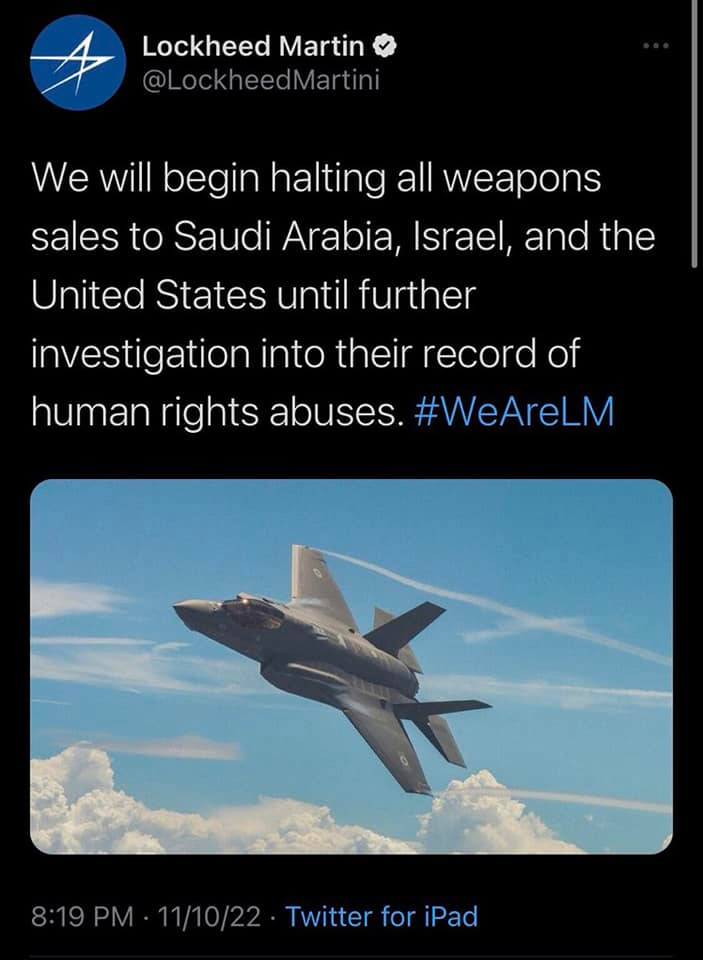

Because tech bros are good at tech and bad at people, Musk, who is their Dark Lord, decided the best way to staunch the hemorrhaging at Twitter was to revamp a subscription service to give users a coveted blue verification check mark for $8 a month. A very real equivalent would be selling college diplomas. You, me, anyone with half a brain knew what would happen next—and did happen next. Users began abusing the subscription service. Twitter accounts with check marks posed as companies like Eli Lilly, blasting out real-looking, check-marked messages about free insulin.

As you might imagine, the real pharmaceutical giant, Eli Lilly, was not amused when its stock tumbled more than 5% in trading last Friday and was still down more than 4% at close.

How about this funny-but-potentially-disastrous spoof account that likely led to a few urgent phone calls to the White House?

Or this, my personal favorite, which made me laugh so hard, I pulled a muscle in my face.

Like Trump, technopreneur Musk refers to himself as a genius. And perhaps credit is due for his genius ability to convince investors and shareholders that he knows what he’s talking about, but in point of fact, all Musk has shown us is that he’s so dense, light bends around him. How’s that for some nerd humor?

Musk is to blame for all of it. In one of his first tweets as the company’s new CEO, he wrote, “Comedy is now legal on Twitter.” It was another tell, yet more evidence of his staggering ignorance of human nature, and a singular inability to comprehend the collective intellectual might of tweeters.

An internal Twitter log seen and reported on by The New York Times showed that more than 140,000 accounts had signed up for the new Twitter Blue checkmark as of Thursday. Forty-eight hours after Musk said he would not add such a label, the company started appending the word “Official” to some accounts to combat impersonation. Their efforts have thus far been unsuccessful. The Washington State Department of Natural Resources noted wryly on its account that the “Twitter wildfire is at 44 billion acres and 0 percent contained.”

So, no, Musk is not off to a good start. Additionally, his Tesla investors are losing money hand over fist. Taken on the aggregate, rich people don’t like losing money. Tesla is headed for its worst year on record, largely because its CEO, Elon Reeve Musk, had to sell Tesla shares to fund his overpriced $44 billion boondoggle, which will almost certainly need more cash infusions in the future.

Moral of the story? Social media platforms need to be cleaned up, regulated, and subject to oversight like any other public utility. We, the people, are the producers of all content on social media. As vox populi, we deserve protection from megalomaniacs like Musk, Zuckerberg, and all the rest of them.

We also need protection in the crypto-sphere. What’s happening there is so squalid and depressing, it would impossible to describe all the graft in even a month’s worth of Cappuccino.

Let’s start with a scam called Celsius.

An Israeli-American named Alex Mashinsky founded a crypto lending service called Celsius, which became one of the largest and best-known services of its kind. In June of last year, Celsius clients began reporting that they couldn’t withdraw their funds. Mashinsky tried to assuage fears by saying the company wasn’t going to halt any withdrawals, but days later, Celsius froze everyone’s accounts and then filed for bankruptcy, walking away with all the liquidity. As further investigations revealed, Celsius functioned exactly like a Ponzi scheme, paying off early investors with funds that came in from more recent investors. And Celsius isn’t the only one.

Quadriga Fintech Solutions, the brainchild of Canadian brojob Gerald Cotten, did the exact same thing that Celsius did, after which he possibly faked his own death. Netflix did a fascinating documentary on the guy, Trust No One: The Hunt for The Crypto King, attempting to solve the mystery. The $250 million he “died with” is still missing.

And now we have thirty-year-old crypto wunderkind Sam Bankman-Fried, who is one of the biggest donors on record for the Democratic Party. He’s given them millions, second only to George Soros. And the Democrats must now inhale a big snootful of Bankman-Fried’s unbearable stench.

At its peak, his cryptocurrency exchange platform, FTX, the world’s largest, was worth $32 billion. But the means by which Bankman-Fried acquired those billions was revoltingly fraudulent. FTX failed to disclose that the market price of its assets was set by trading back and forth with another Bankman-Fried holding, Alameda Research.

The whole thing was a Ponzi scheme. Only when a rival crypto-exchange outfit named Binance decided to engineer a bank run on FTX to prove its insolvency did the ugly truth come to light: Bankman-Fried was a scam artist. His personal net worth, once valued at $15.2 billion according to The Wall Street Journal, is now at zero. This dumpy, unshaven, cargo-short-wearing crypto warrior will likely spend years in federal prison, but none of his investors or the people who believed in him will ever see their money again.

“FTX has an industry-leading brand, endorsed by some of the most trustworthy public figures, including Tom Brady, MLB, Gisele Bundchen, Stephen Curry, and the Miami Heat, and backed by an industry-leading set of investors,” boasted an FTX document obtained by NBC News. “FTX has the cleanest brand in crypto.”

It was all a lie, except for the celebrity endorsements. Celebrities such as Gwyneth Paltrow, Reese Witherspoon, Larry David, Matt Damon, Paris Hilton, Kim Kardashian, Floyd Mayweather, DJ Khaled are just some of A-listers who have been shilling for crypto. In fact, most of the 2021 Super Bowl ads were crypto-related.

In addition to a deplorable lack of social skills, the technoscenti have a woman problem. There are she-bros, but not enough, and certainly not the right kind. All of tech needs a massive infusion—not of financial capital, but female capital. Study after study shows gender diversity makes for greater productivity. It is also worth noting that the most vocal detractors of crypto are well-informed women. Molly White’s fantastic blog, “Web3 is Going Just Great” is a ticker tape of crypto-related malfeasance. I’m also a fan of münecat, whose brilliant takedown of crypto, “Web3.0: A Libertarian Dystopia,” is worth watching. They see, where others do not, that the rules of laissez-faire capitalism cannot and must not be applied to tech. Tech needs oversight. Tech needs regulation. And tech needs women.

There’s no debating tech is a positive IQ playing field. I’m here for that. But its utopian belief that people, if left to their own devices without regulation and oversight, will do what benefits everyone is wildly misguided. They won’t. There is zero evidence indicating that people ever will. We are, underneath the designer suits and $500 haircuts, primates with a little bit of polish.

A typical tech bro’s anarcho-libertarian streak exonerates him of responsibility for others. He’s a nihilist at heart, a glib, malignant narcissist incapable of genuine empathy unless it serves his overall “brand,” and better enables him to manipulate investors. Mark Zuckerberg fits that description to a T. So does Elon Musk.

After everything we’ve been through with Wall Street, banks, crypto, and all the rest of it, do you believe our financial institutions need more—or less—oversight? Should they be trusted to govern themselves?

I don’t believe they should. With crypto especially, the more safeguards in place, the better. Since crypto is a security, everything it does falls within the jurisdictional purview of the Securities and Exchange Commission. Let’s beef up their investigative muscle. Without oversight, crypto will continue to be used as a Dark Web currency for drugs, murder-for-hire, and kiddie porn. And the next time there’s a cryptocurrency meltdown, it could take entire countries with it.

If crypto can’t do better than that, there’s no point in having it.

Copyright © 2022 Stacey Eskelin

Chime in! I want to hear from you. Leave your comments below.

The big question is how do we get more women into tech and crypto who are honest, not like Theranos. Although she may have been swayed by a bro. Tech, especially crypto, needs the same oversight as other financial institutions. Humans ( I called us funky monkeys in an article) aren't good at self-regulation.

I don't mind you slappin' the boys around a bit. It's good fun. But, principally, I sorted through the fun stuff to extract the main thrust of your analysis and arguments with which I agree. There's something niggling at my thought processes, though, something about how things are far more complex than my usual surface assessments. In the capitalist ecosystem all things are connected and interrelated, I suppose. The tech guys are not just exploiting their tech, they also leverage the power of other corporations in their search for quarterly profits and growth, not least the so called main stream media and those who feed at that trough. When a unicorn comes trotting into view, it is showered with attention and a certain credibility is bestowed upon it. We are led to believe that unicorns are not only interesting and beguiling, but real, because most of us are gullible and prey for the confidence men, who are all boys.